Small Business Search

Can You Be Your Own Boss?

How to Perform SWOT Analysis: The Simple Way

A valuable step in your situational analysis is assessing your firm’s strengths, weaknesses, market opportunities, and threats through a SWOT analysis. This is a very simple process that can offer powerful insight into the potential and critical issues affecting a venture.

The SWOT analysis begins by conducting a review of internal strengths and weaknesses in your organisation. You will then note the external opportunities and threats that may affect the organisation based on your market and the overall environment. Don’t be concerned about elaborating on these topics at this stage; bullet points may be the best way to begin. Capture the factors you believe are relevant in each of the four areas. You will want to review what you have noted here as you work through your marketing plan.

The primary purpose of the SWOT analysis is to identify and assign each significant factor, positive and negative, to one of the four categories, allowing you to take an objective look at your business. The SWOT analysis will be a useful tool in developing and confirming your goals and your marketing strategy.

Some experts suggest that you first consider outlining the external opportunities and threats before the strengths and weaknesses. Marketing Plan Pro’s EasyPlan Wizard will allow you to complete your SWOT analysis in whatever order works best for you. In either situation, you will want to review all four areas in detail.

Strengths

Strengths describe the positive attributes,tangible and intangible attributes, internal to your organisation. They are within your control. What do you do well? What resources do you have? What advantages do you have over your competition?

You may want to evaluate your strengths by area, such as marketing, finance, manufacturing, and organisational structure. Strengths include the positive attributes of the people involved in the business, including their knowledge, backgrounds, education, credentials, contacts, reputations, or the skills they bring. Strengths also include tangible assets such as available capital, equipment, credit, established customers, existing channels of distribution, copyrighted materials, patents, information and processing systems, and other valuable resources within the business.

Strengths capture the positive aspects internal to your business that add value or offer you a competitive advantage. This is your opportunity to remind yourself of the value existing within your business.

Weaknesses

Note the weaknesses within your business. Weaknesses are factors that are within your control that detract from your ability to obtain or maintain a competitive edge. Which areas might you improve?

Weaknesses might include lack of expertise, limited resources, lack of access to skills or technology, inferior service offerings, or the poor location of your business. These are factors that are under your control, but for a variety of reasons, are in need of improvement to effectively accomplish your marketing objectives.

Weaknesses capture the negative aspects internal to your business that detract from the value you offer, or place you at a competitive disadvantage. These are areas you need to enhance in order to compete with your best competitor. The more accurately you identify your weaknesses, the more valuable the SWOT will be for your assessment.

Opportunities

Opportunities assess the external attractive factors that represent the reason for your business to exist and prosper. These are external to your business. What opportunities exist in your market, or in the environment, from which you hope to benefit?

These opportunities reflect the potential you can realise through implementing your marketing strategies. Opportunities may be the result of market growth, lifestyle changes, resolution of problems associated with current situations, positive market perceptions about your business, or the ability to offer greater value that will create a demand for your services. If it is relevant, place timeframes around the opportunities. Does it represent an ongoing opportunity, or is it a window of opportunity? How critical is your timing?

Opportunities are external to your business. If you have identified “opportunities” that are internal to the organisation and within your control, you will want to classify them as strengths.

Threats

What factors are potential threats to your business? Threats include factors beyond your control that could place your marketing strategy, or the business itself, at risk. These are also external –you have no control over them, but you may benefit by having contingency plans to address them if they should occur.

A threat is a challenge created by an unfavourable trend or development that may lead to deteriorating revenues or profits. Competition – existing or potential – is always a threat. Other threats may include intolerable price increases by suppliers, governmental regulation, economic downturns, devastating media or press coverage, a shift in consumer behaviour that reduces your sales, or the introduction of a “leap-frog” technology that may make your products, equipment, or services obsolete. What situations might threaten your marketing efforts? Get your worst fears on the table. Part of this list may be speculative in nature, and still add value to your SWOT analysis.

It may be valuable to classify your threats according to their “seriousness” and “probability of occurrence.”

The better you are at identifying potential threats, the more likely you can position yourself to proactively plan for and respond to them. You will be looking back at these threats when you consider your contingency plans.

The implications

The internal strengths and weaknesses, compared to the external opportunities and threats, can offer additional insight into the condition and potential of the business. How can you use the strengths to better take advantage of the opportunities ahead and minimize the harm that threats may introduce if they become a reality? How can weaknesses be minimised or eliminated? The true value of the SWOT analysis is in bringing this information together, to assess the most promising opportunities, and the most crucial issues.

An example

AMT is a computer store in a medium-sized market. Lately it has suffered through a steady business decline, caused mainly by increasing competition from larger office products stores with national brand names. The following is the SWOT analysis included in its marketing plan.

Strengths

- Knowledge. Our competitors are retailers, pushing boxes. We know systems, networks, connectivity, programming, all the Value Added Resellers (VARs), and data management.

- Relationship selling. We get to know our customers, one by one. Our direct sales force maintains a relationship.

- History. We’ve been in our town forever. We have the loyalty of customers and vendors. We are local.

Weaknesses

- Costs. The chain stores have better economics. Their per-unit costs of selling are quite low. They aren’t offering what we offer in terms of knowledgeable selling, but their cost per square foot and per pound of sales are much lower.

- Price and volume. The major stores pushing boxes can afford to sell for less. Their component costs are less and they benefit from volume buying with the main vendors.

- Brand power. Take one look at their full-page advertising, in colour in the Sunday paper. We can’t match that. We don’t have the national name that flows into national advertising.

Opportunities

- Local area networks. LANs are becoming commonplace in small businesses, and even in home offices. Businesses today assume LANs are part of normal office work. This is an opportunity for us because LANs are much more knowledge and service intensive than the standard off-the-shelf PC.

- The Internet. The increasing opportunities of the Internet offer us another area of strength in comparison to the box-on-the-shelf major chain stores. Our customers want more help with the Internet and we are in a better position to give it to them.

- Training. The major stores don’t provide training, but as systems become more complicated with LAN and Internet usage, training is more in demand. This is particularly true of our main target markets.

- Service. As our target market needs more service, our competitors are less likely than ever to provide it. Their business model doesn’t include service, just selling the boxes.

Threats

- The computer as appliance. Volume buying and selling of computers as products in boxes, supposedly not needing support, training, connectivity services, etc. As people think of the computer in those terms, they think they need our service orientation less.

- The larger price-oriented store. When they have huge advertisements of low prices in the newspaper, our customers think we are not giving them good value.

SWOT Analysis: Discover New Opportunities and Manage and Eliminate Threats

SWOT Analysis is a powerful technique for understanding your Strengths and Weaknesses, and for looking at the Opportunities and Threats you face.

Used in a business context, it helps you carve a sustainable niche in your market. Used in a personal context, it helps you develop your career in a way that takes best advantage of your talents, abilities and opportunities. Click here for Business SWOT Analysis, here for Personal SWOT Analysis.

Business SWOT Analysis:

What makes SWOT particularly powerful is that, with a little thought, it can help you uncover opportunities that you are well placed to exploit. And by understanding the weaknesses of your business, you can manage and eliminate threats that would otherwise catch you unawares.

More than this, by looking at yourself and your competitors using the SWOT framework, you can start to craft a strategy that helps you distinguish yourself from your competitors, so that you can compete successfully in your market.

How to use the tool:

To carry out a SWOT Analysis, answer the following questions:

Strengths:

-

What advantages does your company have?

-

What do you do better than anyone else?

-

What unique or lowest-cost resources do you have access to?

-

What do people in your market see as your strengths?

-

What factors mean that you "get the sale"?

Consider this from an internal perspective, and from the point of view of your customers and people in your market. Be realistic: It's far too easy to fall prey to "not invented here syndrome". (If you are having any difficulty with this, try writing down a list of your characteristics. Some of these will hopefully be strengths!)

In looking at your strengths, think about them in relation to your competitors - for example, if all your competitors provide high quality products, then a high quality production process is not a strength in the market, it is a necessity.

Weaknesses:

-

What could you improve?

-

What should you avoid?

-

What are people in your market likely to see as weaknesses?

-

What factors lose you sales?

Again, consider this from an internal and external basis: Do other people seem to perceive weaknesses that you do not see? Are your competitors doing any better than you? It is best to be realistic now, and face any unpleasant truths as soon as possible.

Opportunities:

-

Where are the good opportunities facing you?

-

What are the interesting trends you are aware of?

Useful opportunities can come from such things as:

-

Changes in technology and markets on both a broad and narrow scale

-

Changes in government policy related to your field

-

Changes in social patterns, population profiles, lifestyle changes, etc.

-

Local events

A useful approach for looking at opportunities is to look at your strengths and ask yourself whether these open up any opportunities.

Alternatively, look at your weaknesses and ask yourself whether you could create opportunities by eliminating them.

Threats:

-

What obstacles do you face?

-

What is your competition doing that you should be worried about?

-

Are the required specifications for your job, products or services changing?

-

Is changing technology threatening your position?

-

Do you have bad debt or cash-flow problems?

-

Could any of your weaknesses seriously threaten your business?

Carrying out this analysis will often be illuminating - both in terms of pointing out what needs to be done, and in putting problems into perspective.

Strengths and weaknesses are often internal to your organization. Opportunities and threats often relate to external factors. For this reason the SWOT Analysis is sometimes called Internal-External Analysis and the SWOT Matrix is sometimes called an IE Matrix Analysis Tool.

You can also apply SWOT Analysis to your competitors. As you do this, you'll start to see how and where you should compete against them.

| SWOT can be used in two ways - as a simple icebreaker helping people get together and "kick off" strategy formulation, or in a more sophisticated way as a serious strategy tool. If you're using it as a serious tool, make sure you're rigorous in the way you apply it:

|

Example:

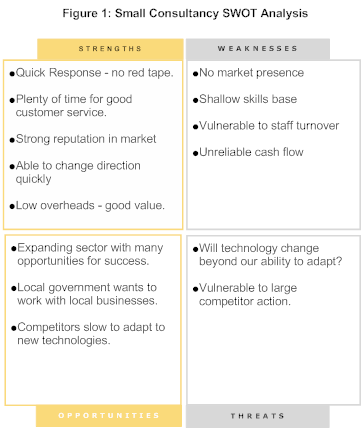

A start-up small consultancy business might draw up the following SWOT matrix:

Strengths:

-

We can respond very quickly as we have no red tape, no need for higher management approval, etc.

-

We can give really good customer care, as the current small amount of work means we have plenty of time to devote to customers

-

Our lead consultant has strong reputation within the market

-

We can change direction quickly if our approach isn't working

-

We have little overhead, so can offer good value to customers.

Weaknesses:

-

Our company has no market presence or reputation

-

We have a small staff with a shallow skills base in many areas

-

We are vulnerable to vital staff being sick, leaving, etc.

-

Our cash flow will be unreliable in the early stages

Opportunities:

-

Our business sector is expanding, with many future opportunities for success

-

Our local council wants to encourage local businesses with work where possible

-

Our competitors may be slow to adopt new technologies

Threats:

-

Will developments in technology change this market beyond our ability to adapt?

-

A small change in focus of a large competitor might wipe out any market position we achieve.

The consultancy may therefore decide to specialize in rapid response, good value services to local businesses. Marketing would be in selected local publications, to get the greatest possible market presence for a set advertising budget. The consultancy should keep up-to-date with changes in technology where possible.

You can see this analysis in diagram format in figure 1 below.

| Drawn using SmartDraw. Click for free download. |

Key points:

SWOT Analysis is a simple but powerful framework for analyzing your company's Strengths and Weaknesses, and the Opportunities and Threats you face. This helps you to focus on your strengths, minimize threats, and take the greatest possible advantage of opportunities available to you.

Article Source: http://www.mindtools.com/pages/article/newTMC_05.htm

Lead Your Small Business To Success Using SWOT Analysis

How to save your business from Bankruptcy

The best way to save your business from bankruptcy is to begin by setting up your finances securely. By setting up your finances with solid original financing, along with a good budget and self-restraint, will help you save your business from ever falling into bankruptcy.

Saving your business from bankruptcy begins with solid financing

If you are going to save your business from financing, first, you need to consider your financing options. You can finance your business through a combination or a sole method: personal financing, friend and family financing, credit card financing, a commercial finance method, or possibly grants from local governments. Ensure that you research all of your options. Setting up your finances also includes determining what all of your expenses are, what your expenses will be, and using accounting software to help control and track your finances.

Business finances have so many different components and things to control that sometimes it seems impossible to keep track of everything. You have to know how much money is going to your expenses, your payables, payroll, inventory, cash, and more. You also have to track your cash flow and any profit that you make. When you make lists of all of your different expenses things become even more difficult to track.

Come up with the most detailed budget you possibly can. Also determine how you are going to track your business finances. Do you have a system in place that is universal across the board? Is it easy to understand your expense tracking system? Do you have guidelines in place for your different kinds of money and how it may be used for different expenses? Are all of your employees trained in your guidelines and how to record expenses?

Using accounting software geared just for small businesses can make it infinitely easier for you to streamline how you track your expenses and control your finances. Accounting software can help you track all of the different aspects listed above, like your payroll, your inventory, and more. Also, accounting software can be adapted for the needs of different types of businesses.

When you are looking for accounting software for your small business, there are several key questions that you need to ask yourself when evaluating your different accounting software options. Here are the questions that you need to review for each particular product.

1. Can this product upgrade and change in its scale as my business grows and changes? 2. Does this product have the different features that my business needs? 3. Can I learn how to use this product easily? Is it easy to use? 4. Is this particular product compatible with my computer system? 5. Does the majority of this product consist of features that I don't actually need? 6. Is this product compatible with the network used by my office? 7. Does the price fit with my business' budget? 8. Does this product's vendor provide online customer support and phone customer support?

Here are some overviews of different small business account software options.

Microsoft Small Business Accounting

Microsoft manufactures a small business accounting software that is similar in interface and procedures to Microsoft Office. If you regularly use Microsoft Office and you like it, then this might be a good choice for you. Microsoft Small Business Accounting software comes with sales order and purchase order processing, inventory management, banking and payroll, and job tracking.

MYOB Mac small business accounting software

If you are a Mac lover, then you will want to investigate MYOB small business accounting software. The basic version of MYOB comes with customer management, expenses, banking, sales, and basic accounting necessities.

If you need more options and features for your business, the higher versions of MYOB come with comprehensive accounting features like purchases and payables, payroll, time billing, contact management, inventory management, appointment scheduling, forecasting, budgeting, banking, contact management, appointment scheduling, logo design, and employee file management.

Some Great Small Business Ideas

Small businesses are these days preferred by many individuals rather than jobs. They need to work for about 6 to 8 hours per day and get limited salaries. They can plan their own time and work towards gaining substantial profits if they start their own business. You can start a business even if you just have any small business idea but you don't have any ready capital. It is so because many banks offer you loans to start your businesses.

You can take a personal loan or a business loan or a mortgage loan too. The banks review your business and idea and do their own research and evaluate the feasibility of the idea. If they think your business proposal can work, they provide you a business loan on the basis of certain terms and conditions. Therefore, you can put your small business ideas to use very easily. Given below are some small business ideas.

1. Business planner:

It is one of the most exciting jobs that one ever can do. You have to actually plan out the business strategies for your client and help him or her gain maximum profits. To start this business though, you need some expert knowledge about start up businesses. You should know all about the financial transactions and other important aspects.

2. Event organizer:

If you have the skill to organize things, you can definitely go for event organizing as your business. People need event organizers to organize marriages, receptions, meetings, trips and all other things that need planning. You can act as the planner and plan out the things foe them considering their financial capacity. This can be the most exciting job that one can ever get. Along with the knack of organizing things, one needs to be creative in mind to organize events in the most elegant way.

3. Public relations:

If you are good at pursuing people, you can start your own business as a public relations official. In this job you need to organize press releases or press conferences. You need to be the link between the media and the public on one side and the events on the other side. As a public relations official you act as a perfect link between the company and its customers. A public relations career is extremely respected everywhere and there is a lot of money in this business.

4. Computer repair:

You can start computer repairing business if you have taken a hardware course. You can also hire experienced computer repairmen and build a team of them. Computer repairing is as easy as any household repairing work. But you should definitely see to it that you have a degree that goes with your business or you can get caught into scandals even if you are perfect at your work.

Thus, one can easily start a small business instead of doing a job. It is not necessary that one should follow ideas already used by people but, one can also innovate and develop new ideas to start a small business.

Article Source: http://business-small-business-gw.blogspot.com/2008/10/some-great-small-business-ideas.html

What Small Business Support Do You Need?

If you are looking for a venture capitalist in order to get your business started, you are in for a fight with other startup ideas. If you plan to take up a loan, be prepared to pay the capital and interest amount for a long period of time. The best way to obtain funds for your startup is via the government small business grant.

However, to get the grant, you must first submit your expenses for scrutiny. Apart from determining your approval outcome, your list of expenses will also determine the amount of grant that you will be getting for your business.

The key to keep in mind when planning your expenses is to keep them as low as possible but at the same time, you have to remember that a cheap grant will not help you in expansion. Padding your expenses by a little might help you to get more money but overdoing it will get you a outright rejection.

How to Minimize Your Startup Business Expenses

There are a lot of aspects in a business where you can cut down your expenses and the following are some of the quick tips that you can you to trim your startup expenses.

Capital expenditure. Yes, you will be able to claim government small business grant for capital expenditure such as plant and machinery purchases, office equipment expenses and furniture acquisitions. Even so, this does not mean that you should include every assets that you desire. Plan your purchases as if you are spending your own money.

Rental expenses. All businesses need a location to get started. Apart from a business address, you definitely need a place to receive calls, meet people and conduct your operations. Renting a garage will definitely be cheaper than renting a full fledge office building. Fancy offices is nothing if your business is not profitable. You may also consider offering your services or goods in exchange for a business location.

Labor expenses. Labor expenses is not cheap nowadays unless part of your business can be outsourced to places like China and India. Talents don't come cheap and securing them is hard. One great way to acquire some talents is to work with colleges and universities as fresh graduates will not mind working for a small business as long as they can pump up their resume.

With all the expenses management tips for startups above, you definitely be able to convince the government that you will utilize the grant properly. Also, the amount of government small business grant will be very desirable for your business.

Article Source: http://business-small-business-gw.blogspot.com/2008/10/what-small-business-support-do-you-need.html

Eleven Land Mines to Avoid When Selling Your Small Business

Now that you are ready to leave or transition your business, how do you do it? It is a question that many small business owners ask - but often when it is too late. Whether you are ready to move on to retirement, or a new business, a successful exit strategy should start three years before your target exit date.

The life of a business owner is both rewarding and exhausting. Many business owners are forced to sell without an exit strategy because of burn out, health problems or financial issues. When you sell your business without a plan, you run the risk of falling hostage to poor financials and bottom-feeding buyers. The sale of a business should be a planned process to yield a business owner the highest possible price for their company.

I see business owners make the same common mistakes when it comes to planning for the next phase of their business. The good news is that with a bit of planning, these 'land mines' can be avoided.

Eleven Land Mines to Avoid When Selling Your Small Business

- Don't become emotional and overprice your business.

- Don't forget to meet with your accountant. Make sure you understand the tax consequences of the sale of your business.

- Don't go to market without a complete marketing package, including three years of financial statements, for potential buyers to review.

- Don't share confidential information about your business with buyers unless they have signed a confidentiality agreement and are financially and professionally qualified.

- Don't let your sales drop after you put your business on the market. No buyer wants to buy a business that is losing money.

- Don't leave deferred maintenance for a buyer. Curb appeal counts in business sales, too.

- Don't rely solely on your competitors to be your only potential buyers. Placing the business on the open market will increase your chances for multiple offers and potentially a higher price.

- Don't wait for an offer to determine if the lease for your space is transferable.

- Don't give a buyer access to all of your financial, customer, and/or employee records until you have agreed in writing on the price and terms of the sale.

- Don't accept an offer without a substantial "good faith" deposit of two to three percent of the offering price.

- Never tell your employees or customers that the business is being sold because it's not over until you have the check in hand!

2007 Julie Gordon White

Articl Source: http://business-small-business-gw.blogspot.com/2008/10/selling-your-small-business-11-land.html

The Importance of Key Business Performance Indicators to Small Business Management

How do you know how well your small business is doing? Do you look at profit? Do you look at your sales numbers? Do you measure growth?

Most businesses use monthly financial statements, which include sales revenues. Some compare those monthly results to the plan and/or to the previous year's results. All business should continue to use that information to manage their business. However, all small businesses should also include more significant key performance indicators as part of their measurement process. As a small business owner, managing-by-measuring performance is a significant key to your success.

Develop a set of key performance indicators (KPIs) to track your business growth and success. These measures will keep you focused on your business goals. When you write your business plan make sure that you include measurable goals and objectives. Then set in place a system that will provide you with regular indications of performance.

KPIs can be easily developed and monitored however each business needs to customize the measurement process to their own business needs.

Here are just a few KPIs you can consider for your business:- Number of orders in a day/week/month/year

- Number of estimates in a day/week/month/year

- What kind of 'win' ratio does your business enjoy (e.g. do you 'win' 15% of all estimates - track this data)?

- How long does it take for you to respond to customer queries: estimate turn-around times; order processing; time from order placement to order delivery; responsiveness in handling customer complaints; and so on?

- How often do you hit your 'promise' date (i.e. the date you promised to deliver the order to your customer)? Analyze the 'misses': ship dates you don't make. Are they with one product line? Or with one customer or type of customer? Or with one employee?

- What kind of employee turn-over rate do you have?

- What kind of customer turn-over rate do you have?

- Percentage of business your largest customer holds?

- Sales by customer

- Sales by customer by product

- Sales by product

Once you start to collect the data, it becomes much easier to see where the problem lies. If you are a manufacturer and you are always late delivering to your largest customer, find out why. Analyze your process. If you are a distributor and you are always late delivering a certain product, find out why. Is your supplier always late? Do you need to carry more inventory of that item? Or in both these examples is it because your employee turn-over is particularly high in the shipping department? Why is turn-over in shipping high? Are you hiring the right people? Are you under-paying? Does your shipping supervisor have weak people skills?

Developing good performance indicators will help you identify and solve issues quickly. Once you have developed KPIs that are aligned with your business goals, and once you track your performance regularly, you will be in a better position to manage your business.

Article Source: http://business-small-business-gw.blogspot.com/2008/07/importance-of-key-business-performance.html

Two Time Management Concepts That Will Help Grow Your Small Business

Time management is an important tool for small business owners - organizing your time and understanding its value to your small business is a great way to become more focused and successful.

1. Time Allocation In order to grow and develop a small business brand, owners and managers need to allocate time to three key functional areas:

- Servicing existing customers

- Searching for new business

- Administration

The time required to achieve a balance between the day-to-day and long term needs of a small business will vary from situation to situation - A good time allocation rule of thumb to start is:

Existing Customers - 60%

Once you get a new customer make sure you keep them by allocating time to:

- Continuing to present your client base with the high level of quality products and services that gained their trust in the first place

- Offering a superior level of ongoing customer service and support

- Developing Incremental business by offering existing customers new products and services

Business Development - 30%

Allocate approximately three quarters of your business development time on marketing, advertising and sales. Some of the tasks you can set aside time for are:

- Preparing quotes and proposals

- Marketing planning and execution which can include (but not be limited to) thinking about your target markets, researching advertising options, implementing ad campaigns such as Google Adwords, newsletter marketing, website content management, etc.

- Sales prospecting i.e. cold calling, etc.

- Researching potential clients, market segments, etc.

Allocate approximately one quarter of your business development time to networking and publishing. Set aside time for:

- Networking events put on by your local chamber of commerce or industry associations

- Meeting with strategic allies, vendors, etc.

- Public speaking

- Tradeshow marketing

- Online social networking i.e. keeping your LinkedIn profile updated; commenting on blogs, etc

- Writing content such as website articles, regular blog posts, etc.

- Writing press releases

Administration - 10%

Small business owners get caught up in the day-to-day and often sacrifice staying up to date on their "paperwork" because it's not a revenue generator - but, if neglected for too long, administration can become costly. Dedicate some time each day, week or month to administration including:

- Bookkeeping and accounting (particularly paying bills and invoicing!)

- Staying up to date with any government documents, important registrations, etc.

2. Time Value Yes, we all know that "time is money"...but, besides direct payment for products/services, how can your small business use time to create value and build brand equity? Here's a hint: don't just think about your time when it's billable...view the time you spend as an investment in building your small business brand and creating trust and value over the long term. Some examples:

- Spend face-to-face time with customers...take time to learn about their business so you are able to better serve them in the future

- Take time to really engage with clients and prospects...don't rush through situations that may not pay immediate dividends...listening builds respect.

- Take time to think...about your business, your strategies, your employees, your vendors...it's too easy to get caught up in the day-to-day and forget the value of spending time developing ideas

- Respect the value of other people's time...when you gain permission to share time with a prospect or client, don't risk eroding the goodwill: Don't be late for meetings; Don't overstay your welcome; Don't waste people's time.

Mark Smiciklas is a Vancouver Marketing Consultant. His firm, Intersection Consulting, helps small to mid-sized businesses address challenges in the areas of marketing, management and business development.

To find out more about Intersection Consulting, please visit http://www.intersectionconsulting.com

For more thoughts and ideas on marketing and management for small business please visit the Intersection Blog at http://www.intersectionconsulting.typepad.com

What To Do When Your Business Isn’t Fun Anymore

One day you wake up and think, “That’s it. It’s time for a change”. As a business owner, there comes a time when you must decide if you want to continue coming to work everyday, facing payroll every two weeks, or perhaps, working through another string of holidays. Just because its time to sell your business does not mean you’re throwing in the towel. Many times small business owners are ready to move on to other things; retirement, a new job, a new venture, more time with family, a focus on personal health, or any combination of factors. Remember, one person’s headache can be another person’s stepping-stone to success. Anyone looking at a business opportunity always thinks they can do a better job. That’s just human nature. And who knows, sometimes it takes a fresh point of view, along with the inevitable fresh influx of capital and elbow grease, to cause a change in direction that will place the business on the fast-charging path to success. As a business owner, you might find yourself running out of steam, or perhaps the business has taken a down turn, but don’t despair. You are what you think about. Sing a song, get out in front of that crowd and, by George, lead the parade to sell your business. Selling your business is an important decision, second only to having taken the original step of buying or starting up in the first place. You would never embark on a new business venture without extreme optimism and enthusiasm, the same energy should exist when it comes time to sell your dream-- don’t sell without giving it 110% effort. Here are the recommended steps to realize your dream of moving on; 1. Decide to decide. 2. Be sure your books are in good order so as to be easily understood by someone who is not familiar with your operation. 3. Clean up the property, after all we’re not considering a “Going Out of Business Sale”; we’re proposing a “Going Into Business Sale”. 4. Decide on a marketing plan and establish a budget to accomplish it. Some directions to consider; (a) classified advertising (b) a direct mail program (c) postings on Internet sights that promote the greater area (d) advertise outside the immediate area (e) post on web pages that sell business opportunities like BizBen.com & USABizMart.com 5. Or avoid the above steps and retain the full marketing services and expertise of a commercial real estate or business brokerage firm. Let them do all the time and money-consuming promotions, advertising, pre-qualifying appointments, and detail management that go into locating quality prospective buyers. There will always be someone out there willing to trade places with you. Just think positive. It’s been said that you achieve a powerful peace of mind once you decide to sell; you’re just taking your hopes and dreams and moving on to a new level. Happy selling! The Article source is: http://www.bizben.com/blog/posts/793-business-isnt-fun-anymore.php

The Financial Management Planning For Small Business

Studies overwhelmingly identify bad management as the leading cause of business failure. Bad management translates to poor planning by management. All too often, the owner is so caught up in the day-to-day tasks of getting the product out the door and struggling to collect receivables to meet the payroll that he or she does not plan. There never seems to be time to prepare Pro Formas or Budgets. Often new managers understand their products but not the financial statements or the bookkeeping records, which they feel are for the benefit of the IRS or the bank. Such overburdened owner/managers can scarcely identify what will affect their businesses next week, let alone over the coming months and years. But, you may ask, "What should I do? How can I, as a small business owner/manager, avoid getting bogged down? How can I ensure success?" Success may be ensured only by focusing on all factors affecting a business's performance. Focusing on planning is essential to survival. Short-term planning is generally concerned with profit planning or budgeting. Long-term planning is generally strategic, setting goals for sales growth and profitability over a minimum of three to five years. The tools for short- and long-term plans have been explained previously in this section: Pro Forma Income Statements, Cash Flow Statements or Budgets, Ratio Analysis, and pricing considerations. The business's short-term plan should be prepared on a monthly basis for a year into the future, employing the Pro Forma Income Statement and the Cash Flow Budget. Long-Term PlanningThe long-term or strategic plan focuses on Pro Forma Statements of Income prepared for annual periods three to five years into the future. You may be asking yourself, "How can I possibly predict what will affect my business that far into the future?" Granted, it's hard to imagine all the variables that will affect your business in the next year, let alone the next three to five years. The key, however, is control - control of your business's future course of expansion through the use of the financial tools explained in this section. First determine a rate of growth that is desirable and reasonably attainable. Then employ Pro Formas and Cash Flow Budgets to calculate the capital required to finance the inventory, plant, equipment, and personnel needs necessary to attain that growth in sales volume. The business owner/manager must anticipate capital needs in time to make satisfactory arrangements for outside funds if internally generated funds from retained earnings are insufficient. Growth can be funded in only two ways: with profits or by borrowing. If expansion outstrips the capital available to support higher levels of accounts receivable, inventory, fixed assets, and operating expenses, a business's development will be slowed or stopped entirely by its failure to meet debts as they become payable. Such insolvency will result in the business’s assets being liquidated to meet the demands of the creditors. The only way to avoid this "outstripping of capital" is by planning to control growth. Growth must be understood to be controlled. This understanding requires knowledge of past financial performance and of the future requirements of the business. These needs must be forecast in writing - using the Pro Forma Income Statement in particular - for three to five years in the future. After projecting reasonable sales volumes and profitability, use the Cash Flow Budget to determine (on a quarterly basis for the next three to five years) how these projected sales volumes translate into the flow of cash in and out of the business during normal operations. Where additional inventory, equipment, or other physical assets are necessary to support the sales forecast, you must determine whether or not the business will generate enough profit to sustain the growth forecast. Often, businesses simply grow too rapidly for internally generated cash to sufficiently support the growth. If profits are inadequate to carry the growth forecast, the owner/manager must either make arrangements for working growth capital to borrowed, or slow growth to allow internal cash to "catch up" and keep pace with the expansion. Because arranging financing and obtaining additional equity capital takes time, this need must be anticipated well in advance to avoid business interruption. To develop effective long-term plans, you should do the following steps: 1. Determine your personal objectives and how they affect your willingness and ability to pursue financial goals for your business. This consideration, often overlooked, will help you determine whether or not your business goals fit your personal plans. For example, suppose you hope to become a millionaire by age 45 through your business but your long-term strategic plan reveals that only modest sales growth and very slim profit margins on that volume are attainable in your industry. You must either adjust your personal goals or get into a different business. Long range planning enables you to be realistic about the future of your personal and business expectations. 2. Set goals and objectives for the company (growth rates, return on investment, and direction as the business expands and matures). Express these goals in specific numbers, for example, sales growth of 10 percent a year, increases in gross and net profit margins of 2 to 3 percent a year, a return on investment of not less than 9 to 10 percent a year. Use these long-range plans to develop forecasts of sales and profitability and compare actual results from operations to these forecasts. If after these goals are established actual performance continuously falls short of target, the wise business owner will reassess both the realism of expectations and the desirability of continuing to pursue the enterprise. 3. Develop long-range plans that enable you to attain your goals and objectives. Focus on the strengths and weaknesses of your business and on internal and external factors that will affect the accomplishment of your goals. Develop strategies based upon careful analysis of all relevant factors (pricing strategies, market potential, competition, cost of borrowed and equity capital as compared to using only profits for expansions, etc.) to provide direction for the future of your business. 4. Focus on the financial, human, and physical requirements necessary to fulfill your plan by developing forecasts of sales, expenses, and retain earnings over the next three to five years. 5. Study methods of operation, product mix, new market opportunities, and other such factors to help identify ways to improve your company's productivity and profitability. 6. Revise, revise. Always use your most recent financial statements to adjust your short- and long-term plans. Compare your company's financial performance regularly with current industry data to determine how your results compare with others in your industry. Learn where your business may have performance weaknesses. Don't be afraid to modify your plans if your expectations have been either too aggressive or too conservative. Planning is a perpetual process. It is the key to prosperity for your business. The Article Source is: http://www.bizmove.com/finance/m3b8.htm |

How to Keep Your Best Ones, The Number One Asset For YourCompany

On earlier posts here, I’ve offered some advice, tips and resources, I’ve found useful in:

- [1] Recruiting the best potential candidates to interview;

- [2] Interviewing thoroughly, consistently, with the goal of hiring only A-Players.

Let’s talk about how to keep your best ones, your best employees and colleagues. These are your Best Ones.

Your employees are the number one asset for your company. And your Best Ones are your leaders, those who set the tone, for and create your brand. They sustain your brand, their brand, through good times and not-good times. ( Your company is thought of as their company if you’ve recruited the best and interviewed to hire only A-players. A-players take ownership. And you want that. You want everyone thinking that it’s their company. )

How do you keep your best employees, your leaders, the ones most engaged in making your brand…their brand?

I’ve thought about this post for a few weeks now. I came across two smart business-thinkers, from different industries, who shared a simple theme for keeping your employees engaged and inspired.

Everybody goes home happy. That’s one of Jake McKee’s mantras. Everybody means everybody: customers and employees. Jake blogs at [3] CommunityGuy and is the Chief Ant Wrangler and Principal for [4] Ant’s Eye View, a Dallas-based customer collaboration strategy agency. You can listen to our recent conversation about building community around everybody going home happy at [5] BlogTalk Radio recently.

Makes sense. Leave a smile on the face of everyone touched by your brand…they’ll come back.

What is the "Small Businesses of the Future"?

Intuit just released the first installment of a report called, “Future of Small Business.” The report forecasts what the small business landscape will look like in the United States over the next 10 years, to 2017.

And it is a fascinating picture:

(1) More diversity – Small businesses are more diverse than ever, with women starting businesses and immigrants refreshing the ranks of business owners. Baby Boomers (those born between 1946 and 1964) — their numbers are rising faster in small business than any other age group. This chart outlines the demographic characteristics of key small business owner segments (click image below to open PDF in new window):

(2) Rise of the Personal Business — The “personal business,” which is a new term to describe a business with no employees, is growing in numbers and in economic influence. These businesses now number roughly 20 million. These personal businesses are a large presence in our economy. “Free agent” working relationships are now seen as more attractive by younger and older workers.

(3) Entrepreneurial Education Grows – Entrepreneurial education is growing, especially at the university level, with over 1,600 higher education institutions offering such entrepreneurship education in some fashion. More people starting businesses will have training in the skills necessary to be successful as an entrepreneur. And it’s a good thing, because with the increasingly complex marketplace, they are going to need them.

I was fortunate to play a part in the development of this report. Last summer I participated in an expert workshop at the Institute for the Future in Palo Alto, California. Professor Jeff Cornwall, over at the Entrepreneurial Mind, also was one of the participants, along with the rest of an impressive panel. It was stimulating and fun to share ideas.

It is good to see that Intuit and the Institute for the Future are releasing the report publicly. Many educational institutions, economic development authorities, and even smaller vendors that sell to other small businesses, can get value out of this report. Download your copy of the first installment of the Intuit Future of Small Business Report.

The Acticle Source is:

http://www.smallbiztrends.com/2007/01/small-businesses-of-the-future.html/

U.S. Small Business Administration: The "SBA's 8(a) BD Program" Part 3

And finally, the third part of the FAQs of the "SBA's 8(a) BD Program" here:

23. What is a super majority?

A super majority is the percentage of votes above a simple majority (51%) required to make decisions on behalf of the firm.

24. Are there restrictions placed on nondisadvantaged individuals in terms of their relationships with disadvantaged individuals and/or applicant firm? When a Participant fails to provide documentation for annual review, SBA may initiate termination proceedings. Yes. Nondisadvantaged individuals may be involved in the ownership and management of an applicant firm, as stockholders, limited liability members, partners, directors, and/or officers. However, no such nondisadvantaged individual or immediate family member may

25. What factors are considered by SBA in evaluating the potential for successful 8(a) requirement? SBA will evaluate the following:

26. Does SBA have a minimum length of time in business requirement for 8(a) program certification? Yes. The applicant firm must have been operational for at least two full years as evidenced by business income tax returns for each of the two previous tax years which show operating revenues in the primary industry in which the applicant firm is seeking 8(a) program certification.

27. Can a firm still apply for participation in the 8(a) BD Program if it has not been in business for two full years? Yes. However, the firm must obtain a waiver of the two years in business requirement by meeting all of the following conditions:

28. Can a firm be declined entry into the 8(a) Program for reasons of character? Yes. The regulations stipulate that the applicant concern and all its principals must have good character. SBA may determine that a lack of character demonstrated by any one of the following circumstances:

29. Are brokers eligible for the 8(a) BD Program? No. Brokers are not eligible for the program. A broker adds no material value to an item supplied to a procuring activity, does not take ownership or possession, and does not handle the item procured with its own equipment or facilities. If the applicant firm is a broker, but does not meet this definition, the firm may be eligible for 8(a) program participation.

30. What happens if an 8(a) Program applicant firm or any of its principals fail to pay significant financial obligations owed to the federal government? If an applicant firm or any of its principals fail to pay significant financial obligations owed to the federal government, including unresolved tax liens and defaults on federal loans or other federally assisted financing, the applicant firm will be ineligible for 8(a) program participation.

31. How long does the 8(a) BD application process take? The regional Division of Program Certification and Eligibility (DPCE) has 15 days to review the application for completeness. If the application is incomplete, the applicant will have 15 days to provide additional information. If the DPCE determines the application is complete, a final decision regarding 8(a) BD Program eligibility will be made within 90 days after SBA's determination that the application is complete.

32. What if an 8(a) Business Development Program application is declined? Each program applicant has the right to request that SBA reconsider a declined application by filing a written request for reconsideration within 45 days after receiving notice that the application was declined. The applicant has the burden of overcoming each reason cited in SBA's decision to decline the application. During the reconsideration process, the applicant must provide any additional information and documentation necessary to overcome the reason(s) for the initial decline. If an application is declined after reconsideration, SBA will not accept a new application until twelve (12) months after the date of the final Agency decision on reconsideration In addition, if an applicant is declined solely on issues of social disadvantage, economic disadvantage, ownership, control, or any combination of these four criteria, the declined applicant may appeal the decline decision to SBA's Office of Hearings and Appeals (OHA). This can happen either after receiving the initial decision to decline the application or after receiving a negative decision on reconsideration. OHA examines the decline decision to determine whether it was arbitrary, capricious, or contrary to law. No new or revised information is considered during the appeal process.

33. How long can a company participate in the 8(a) program? Program participation is divided into two stages: the developmental stage and the transitional stage. The developmental stage is four years and the transitional stage is five years. The developmental stage is designed to help 8(a) certified firms overcome their economic disadvantage by providing business development assistance. The transitional stage is designed to help participants overcome the remaining elements of economic disadvantage and to prepare participants for leaving the 8(a) program.

34. Are 8(a) firms reviewed by SBA annually for compliance with eligibility requirements? Yes. As part of an annual review, each Participant firm must submit to the servicing district office the following:

35. What does it mean to be "terminated" from the 8(a) BD Program? The term "terminate" is used to refer to a Participant's exit from the 8(a) BD Program prior to the expiration of its program term for good cause. Examples of good cause include, but are not limited to the following:

36. What does it mean to "graduate" from the 8(a) BD Program? The term "graduate" is used to refer to a Participant's exit from the 8(a) BD Program at the expiration of the Participant's term.